The warnings scientists have made about our planet’s climate changes are materializing and becoming the biggest challenge of our lifetime. The climate crisis is a symptom of decisions that didn’t consider a broader spectrum or long-term impact.

As designers in a financial institution, one of our primary goals is to seek an understanding of our customers and the underlying problems they might experience while interacting with us.

Empathising is one of the best ways for us to gain an understanding of our customers, their problems, needs, desires, feelings, and thereby truly get a chance to see and understand the world through their eyes. The ability to empathise is one of the most important skills to possess as it is a vital part in the process of good design, an essential element in design thinking as well as the area of human-centred design.

However, understanding our customers, gaining empathy, and documenting the insights is one thing but it is simply not enough. The identified problems must be shared and presented to our colleagues to help them understand our customers and accordingly prioritise their needs in symbiosis with our business goals and technical feasibility.

In some cases, this can be a challenging task as it can involve several colleagues who all might have their own feature focus, and they might even be spread across several departments. So, how might we make our customers more relatable across departments and at the same time strengthen customer empathy? One approach we have found useful is to utilise the power of life stages as it helps to provide a holistic understanding of our customers and their life situations.

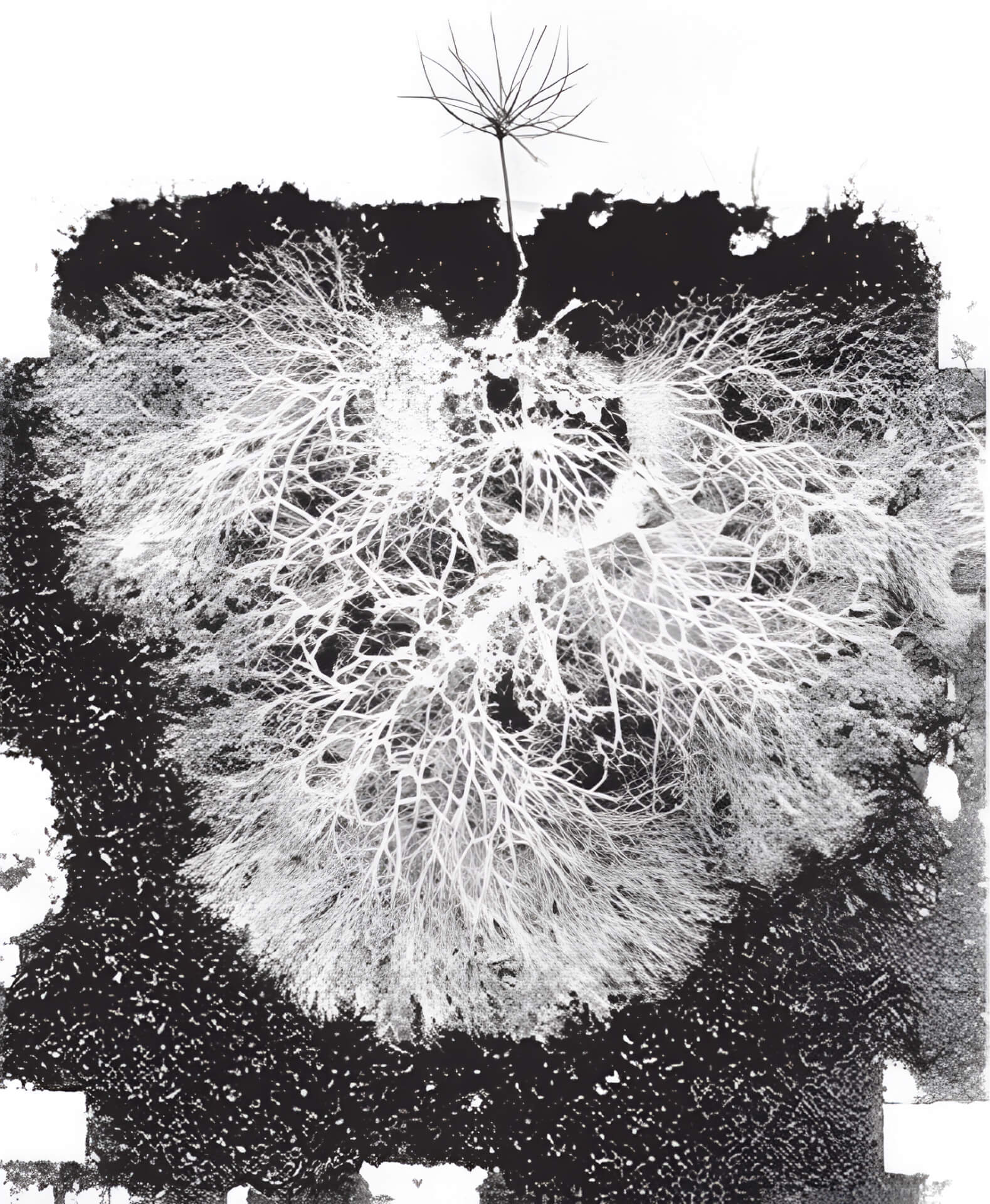

Life stages refer to the different phases of life we as individual human beings pass through in one way or another. It is a way to divide the journey of life into several smaller stages, which helps to define the human development as a process.

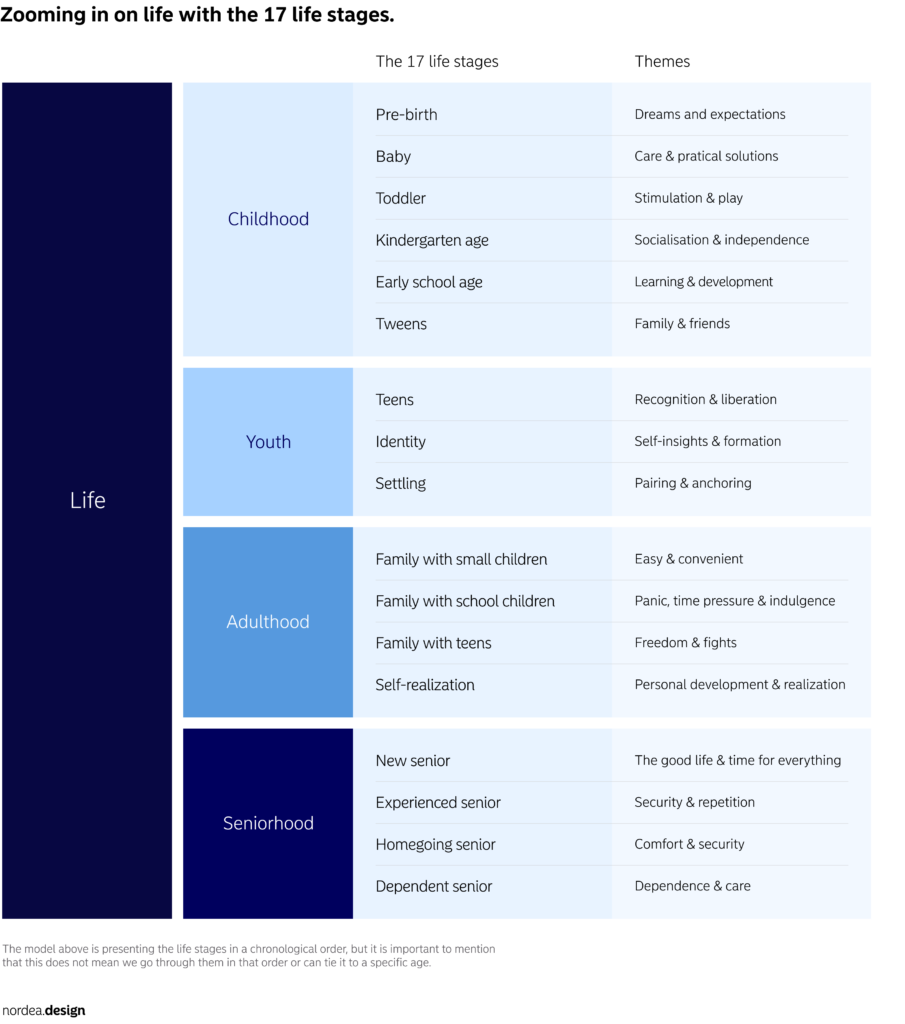

However, when thinking about life we know that many of us tend to categorise it into four overall stages: childhood, youth, adulthood, and seniorhood.

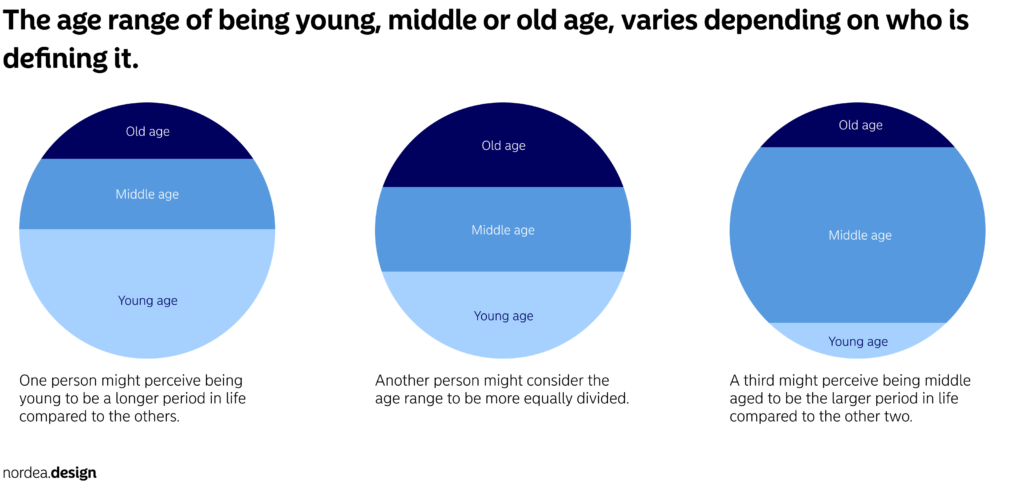

But life is much more complex and involves several other stages, events, and challenges. Therefore, we found it important to avoid such a high-level perspective on life, as we have learned that the individual understanding and definition of being a young person, an adult, or a senior varied from department to department and even from person to person. When diving deeper into these high-level definitions, we found that the age span used to define a young person was quite different. The individual understanding and definition of a young person would vary in terms of age. To some, a young person would be between 18 to 24 years old and to others, it would mean a person between 18 to 40 years old, which potentially would create miscommunication throughout the organisation.

Therefore, we have found it relevant to zoom in a bit more, divide life into more stages, move away from the high-level perspectives, and even to some extent move away from age segmentation, as it ultimately does not tell us that much about our customers.

A customer who is 42 years old can potentially be in the same life stage as a person who is 27 years old, which is why using chronological age is not the best criterion to use for describing a person’s behaviour.

The model we have found to be the most useful, is the 17 life stages first presented by the Scandinavian trend institute, pej gruppen, in 2007.

The model is rooted in consumerism, which makes it a more qualitative and intuitive model compared to traditional segmentation models where age and gender often are found to be some of the leading variables. With the 17 life stages, we are able to look at people, their spending habits, and capture the life events they might be heading towards and connect them to a business opportunity in terms of better advice or a relevant financial service offering.

It is of course important to remember that working with life stages does not mean that all stages are equally important or relevant to work with. It might not even be relevant to apply the life stage thinking to every single research project we conduct, which is why we are carefully considering when, how, and where to take in the life stage perspective in our work.

Still, in most cases, the life stages are connected but it is of course not the infant in the pre-birth stage who is spending money, but the future parents or parent to be.

The life stages simply provide us with an inspirational and holistic picture of how our customers go through life, where they are at in life, and where they might be heading. Understanding the above is exactly how it is helping us to strengthen customer empathy across teams and departments.

We all experience the journey of life as we go through it individually or with a partner. But we also experience life through our parents, grandparents, and even great grandparents in some cases.

Even though we might not have entered the life stage of an experienced senior yet, it is a life stage our grandparents might be in the middle of, and through them, we will have experienced parts of this life stage. This helps us and our colleagues with creating an emotional connection to that life stage and to those customers in this life stage, which makes them more relatable, thereby strengthening the customer empathy.

Life stages can help us obtain and provide perspective for ourselves and our colleagues. We might tend to be too feature-focused or only focus within our own business area and forget to apply an outside view on our customers. Looking at our customers’ life stages can help us look more generally at our customers and not only look at the case in front of us. It can even be argued that understanding the life stages can help debias our decisions, lead us away from an inside view, and guide us towards an outside view as it takes a more general view on the Nordic population.

As Personal Banking is our largest business area in terms of earnings and number of employees, we must remember every now and then to look at our customers holistically and understand their needs from a general perspective. We do not only serve customers looking for a mortgage or a consumer loan. In many cases, we provide them with several services and if we do not, there is an opportunity for us to serve more than just one of their needs as they continue their journey through life.

The warnings scientists have made about our planet’s climate changes are materializing and becoming the biggest challenge of our lifetime. The climate crisis is a symptom of decisions that didn’t consider a broader spectrum or long-term impact.

This content is restricted.

As designers in a financial institution, one of our primary goals is to seek an understanding of our customers and the underlying problems they might experience while interacting with us.